The Basics of Vehicle Instalments

Looking to finance a vehicle? If so, there are a few things you need to know. Before you start your search for a new or second-hand car, the first thing to consider is how much you can afford to pay towards purchasing one. It’s also important to account for other vehicle expenses such as car insurance, which comes with its own set of premiums.

Unless you’re buying a car cash, there are two important affordability questions to ask yourself:

- What lump sum amount can I pay upfront as a deposit?

- How much can I afford on a monthly basis?

Other than knowing what your budget is, is understanding the length of period you will be paying off the loan, in order to calculate what the monthly instalment will be.

Finance periods

The finance term is agreed to upfront and can range from 12 to 72 months or even more. This equates to 1 to 6+ years. The longer the finance term, the less your monthly instalments will be, but bear in mind that while it looks good in the short term, you’ll have to pay interest on the loan. This means you’ll actually end up paying a lot more for the vehicle once you’ve finally finished paying it off.

What if I can’t pay?

Of course, a lengthy payment term poses a fair amount of risk because nothing in life is guaranteed – being able to maintain a job depends on it. If you’re unable to continue with your monthly payments, the bank may agree to freeze your instalments for a short time to help you get back on your feet. Failing to pay thereafter will be seen as a breach of contract and your car will be repossessed.

This doesn’t mean you may stop paying – the bank will still expect the balance of the cost after the car has been resold (shortfall), along with other charges.

Do I still have to pay if I have an accident or the car is stolen?

Things can get complicated here. If the car is considered a write-off or stolen you may still need to continue paying instalments for a period of time. How much and for how long depends on the type of insurance you have, how long you’ve had the car for, and other variables that you will need to speak to your insurance company about.

Loan calculations

In order to figure out the exact instalment amount to be paid monthly, the bank or finance institution will take the price of the vehicle, subtract the deposit amount you put down (in some cases required to secure the vehicle), and calculate the instalments based on the finance period.

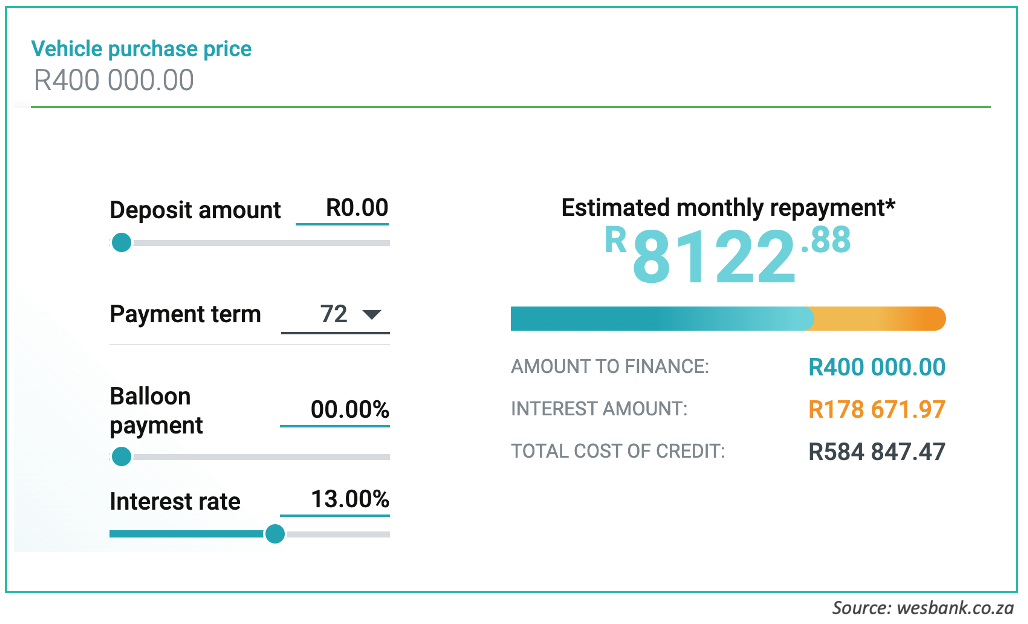

To get a rough idea for yourself, you can use an online calculator – most of the major banks and financial institutions have one such as Absa and Westbank. These are easy to use and Standard Bank’s calculator has a handy Affordability calculator as well.

To calculate you will need to input:

- The total purchase price of the vehicle including VAT and optional extras.

- The deposit amount that you want to put in.

This will give you a good idea of what you can expect to pay every month according to the loan term you selected. Other useful information offered is how much interest you’ll pay for the term and the total cost of the vehicle after interest and fees. This helps you choose a payment plan that suits your pocket and situation.

Here’s an example:

What is a balloon payment?

After scrutinising the example above, you may be wondering about balloon payments. This is basically a substantially larger sum that is paid at the end of the loan period, the purpose being to reduce the initial instalment amounts. Therefore, they are just different ways of spreading the cost.

A balloon payment option is only available for shorter-term loans and best for those with a good amount of savings and is secure in their income stream.

Now that you have a better understanding of instalments you can make better-informed decisions about financing a vehicle. If you have any further questions, contact Auto Pedigree – we also have financial arrangements with all major banks in South Africa and can help you find the best package for your needs.

Disclaimer: This information is for educational purposes only. It must not be construed as advice, legal, financial, or otherwise. We do not make any warranties about the completeness, reliability, and accuracy of this information. The views and opinions are those of the author and not necessarily those of Auto Pedigree.